As we close out 2024, we’re proud to end the year on a high note. Across Tempus Evergreen and Tempus Direct Investments, we acquired $68 million worth of industrial and manufacturing properties, totaling 872,000 square feet. Every completed transaction is the result of a rigorous due diligence process—one that often doesn’t lead to a deal. By year-end, the Tempus team had underwritten $1.7 billion in transactions, navigating an evolving market landscape along the way.

Interest Rates & Market Trends

At the start of 2024, expectations were for six Federal Reserve rate cuts, bringing the Federal Funds Rate down to 3.75%-4%. However, inflation, a strong labor market, and steady economic growth led to only three cuts, ending the year at 4.25%-4.50%. Looking ahead, FOMC projections suggest just 50 basis points of rate cuts in 2025, signaling that interest rates may stay elevated for longer than anticipated.

Industrial Market: Strong, But Evolving

The U.S. industrial sector remained resilient in 2024, but for the first time in five years, the story comes with nuance. The sector’s explosive growth, fueled by the shift to online retail plus reshoring, has driven high demand for warehouses, distribution centers, and manufacturing centers, leading to a supply boom.

- Rising Rents: Average industrial rents rose 6.6% year-over-year to $8.30 per square foot.

- Development Slowdown: After 1.1 billion square feet of new industrial space was delivered in 2022-2023, 2024 saw a sharp decline to 236 million square feet. The trend is expected to continue in 2025, with new developments increasingly focused on data centers.

- Vacancy Rates Climbing: National industrial vacancy rates rose to 8%, a significant jump from 4% in 2022. This shift is most apparent in port markets like Southern California, where vacancy rates surged from below 2% to 7.8% by year-end.

Looking ahead, we expect investment demand for single-tenant net lease industrial properties to continue strengthening. In Q4 2024, this segment saw a 24% increase in sales quarter-over-quarter and an 87.2% year-over-year jump. Institutional and international investors remain active, representing 44% of transactions. In our recent transactions, we have seen a substantial increase in competition for these assets from larger buyers such as Broadstone, W.P. Carey, Hillstone, Angelo Gordon, and others.

Office Market: Signs of Stabilization

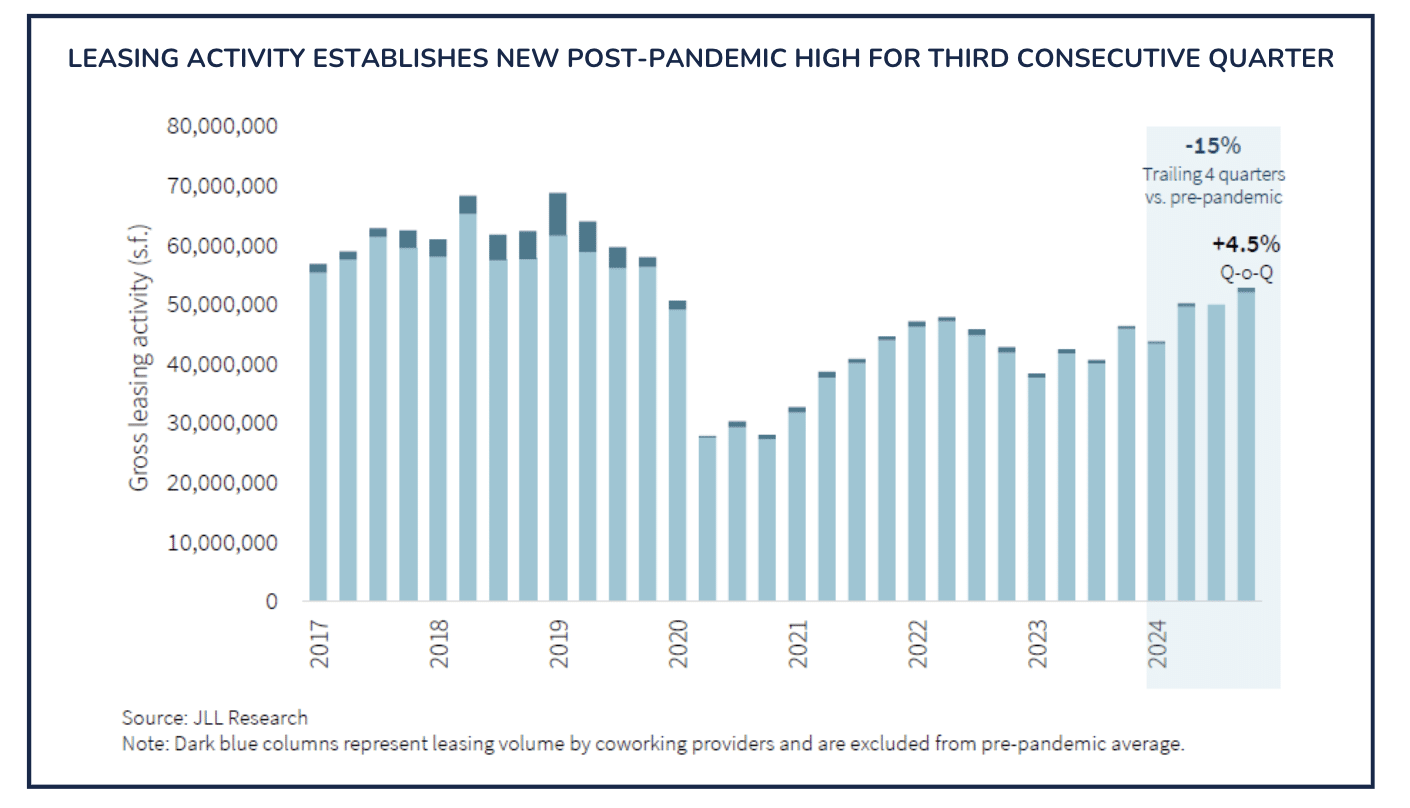

After years of headwinds, including tepid leasing demand and declining prices, the office market shows signs of plateauing vacancy rates and prices stabilizing. Q4 2024 was the most encouraging quarter since the pandemic, marking:

- First quarter of positive net absorption since 2021

- Leasing activity at 92% of pre-pandemic levels, with 52.9 million square feet leased

- Major corporations like Amazon, AT&T, and Dell mandating return-to-office, boosting demand for high-quality office space

The trend of “flight to quality” remains strong. Tenants are prioritizing well-amenitized, modern buildings, particularly Class A properties. According to JLL, first-generation office space rents grew 16.9% year-over-year, while second-generation and renewal leases saw 7% growth.

Another positive indicator: The sublease market improved for the third consecutive quarter, with availability down 3.8% from its early 2024 peak. Meanwhile, new office construction remains at historic lows, which should help stabilize rental rates in the coming quarters.

Across our Tempus office portfolio, we’ve seen increased leasing activity and are aggressively pursuing new tenants to drive occupancy. Many of our neighboring landlords are struggling with financing, as banks are hesitant to issue additional debt, effectively removing undercapitalized buildings from the competitive landscape.

Looking Ahead to 2025: A Year of Opportunity

Blackstone President Jon Gray recently stated, “Office has bottomed, particularly in stronger markets and better-quality buildings; valuations for US offices have tumbled 50 to 70 percent from their peak, and they’re poised for a rebound.” This statement marks a shift in Blackstone’s retreat from office, and they are currently under contract to purchase new flagship properties.

We see this playing out firsthand from speaking with our local partners across the country. In order to rebalance their portfolios, many of the largest institutional investors have exited office at extremely low values due to mandated sales.

With this drastic approach by so many, we are seeing more opportunities for flagship quality properties in some of the country’s most attractive markets. Many of these properties trade at significant discount to replacement cost, and the recent flight to quality has pushed rental rates and occupancy for best-in-class space well above market averages. As we assess potential investments, we will be highly selective, but we believe 2025 may offer some of the most compelling investment opportunities in years for select office properties.

In the industrial sector, we continue to see sale-leaseback opportunities, but with increased competition from capital that was previously on the sidelines or focused on new developments; we will remain conservative in our underwriting and expect fewer of these deals until the market changes. We also expect select opportunities for development to surface as we work with our local market relationships. Additionally, we are looking at our current portfolio to take advantage of the strengthening capital appetite for long-term leased industrial property to find disposition opportunities throughout the year.